What is a Chart of Accounts? Types, Definition, Examples

Content

- Nail Down Cost of Revenue vs. Operating Expense

- Liabilities are just that, monies owed or due for payment by your organization

- Master Your Finances With Our Chart of Accounts Guide for Small Business Owners (

- What is the best software to assist in

- The importance of a chart of accounts for small businesses

Assets represent resources with economic value anticipated to deliver future value to the organization. The balance sheet provides an overview of assets,

liabilities, and stockholders’ equity at a specific point

in time. These “buckets” correspond to different reporting statements, which are generally split to include the balance sheets, income statements, and any work in progress reports.

However, they also must respect the guidelines set out by the Financial Accounting Standards Board (FASB) and generally accepted accounting principles (GAAP). This includes entering the umbrella categories and your chosen subcategories. Once you’ve set it up you’ll be able to tag each transaction and file it under the relevant subcategory, easily. Here’s an example of what a chart of accounts might look like with a numbering system in place. In most cases, you can map your GL accounts to a somewhat standard set of categories. Travel & Related, Sales & Marketing, Professional Services, Facilities & Related—these are all mainstays of the CoA and are fairly straightforward.

Nail Down Cost of Revenue vs. Operating Expense

But, the need may come where your business is expanding its territory, or you have to add a new loan account. Utilize our chart of accounts numbering best practices and unlock your ledger like a pro bookkeeper. Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified. A company’s organization chart can serve as the outline for its accounting chart of accounts. Each department will have its own phone expense account, its own salaries expense, etc. There is a generally accepted numbering structure for the accounts, so everyone’s accounts appear in roughly the same order and with similar numbering.

- If you’re booking payroll entirely to OpEx, you might be understating your cost of revenue and boosting your reported margins in the process.

- Shopify Balance is a free financial account that lets you manage your business’s money from Shopify admin.

- The chart of accounts is a listing of all accounts used in the general ledger of an organization.

- However, it is imminent, that you will need to expand your accounts in the future, so it is recommended not to add accounts drastically.

- Increasing the size of a business increases the complexity of the chart of accounts.

- But if you cross the line and go too granular, you’ll never be able to take a step back and track big picture trends.

The best chart of accounts structure is the one that perfectly aligns with how your business operates and how you want to analyze it. Following best practices for high-level account numbering is a good starting point. But you have to go a step further and decide what level of granularity is necessary in each account category.

Liabilities are just that, monies owed or due for payment by your organization

That’s why you have to think carefully about what exactly to include in cost of revenue compared to OpEx when building your CoA structure. You can clean up your general ledger by taking the single account approach to department tagging as long as you have a software solution that can automate the process and help you slice the data as needed. You don’t want to make your CoA so broad that you can’t get any actionable insights about the business.

In this case, it identifies

the exact type of Fixed Asset

being referenced. FloQast’s suite of easy-to-use and quick-to-deploy solutions enhance the way accounting teams already work. Learn how a FloQast partnership will further enhance the value you provide to your clients. We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA).

Master Your Finances With Our Chart of Accounts Guide for Small Business Owners (

The chart of accounts is a very useful tool for the access it provides to detailed financial information for individuals within companies and others, including investors and shareholders. The charts of accounts https://www.bookstime.com/articles/chart-of-accounts-numbering can be picked from a standard chart of accounts, like the BAS in Sweden. In some countries, charts of accounts are defined by the accountant from a standard general layouts or as regulated by law.

If your company is an S or C corporation or an LLC corporation, it should have a Common Stock account and sometimes a Preferred Stock account. Common stock and preferred stock represent the total sum of stock the company has issued. An LLC might have Member stock if there is more than one person who owns stock. Your capital account structure depends on whether your company is organized as a sole proprietorship, partnership, or corporation. When the $20,000 loan was deposited to the checking account, the deposit was entered in the liability account Bank Loans, not an income account.

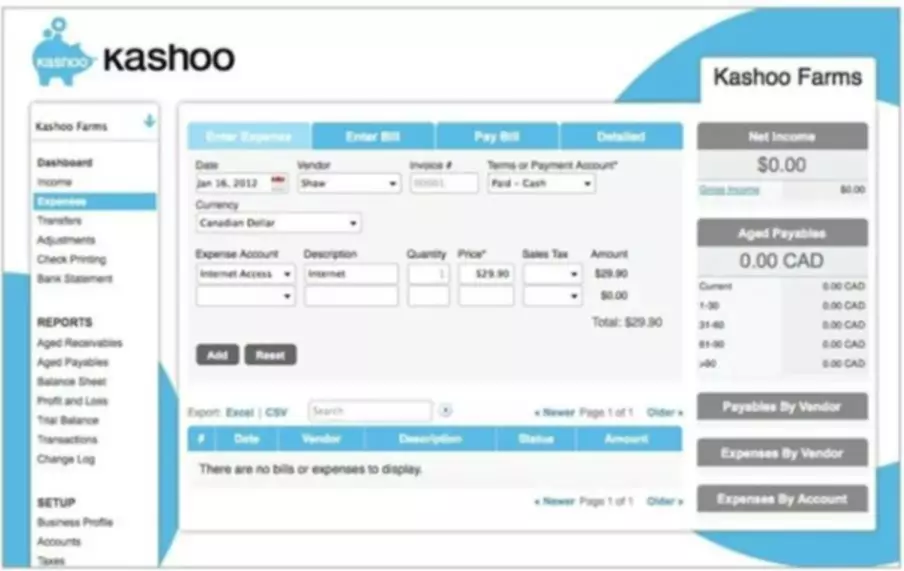

What is the best software to assist in

If you are changing software, it might take some time to set up and properly categorize your transactions. The process will vary depending on the accounting software you use, so take a look at tutorials and demos that can help you get set up quickly. A chart of accounts is an index of financial transactions your company has made during a certain time frame—usually a dedicated accounting period. Each transaction is organized by category to provide a clear breakdown of what was earned and spent. The main components of the income statement accounts include the revenue accounts and expense accounts. The chart of accounts is a numbered list of all accounts used to record and summarize business transactions.

Many organizations structure their COAs so that expense information is separately compiled by department. Thus, the sales department, engineering department, and accounting department all have the same set of expense accounts. Examples of expense accounts include the cost of goods sold (COGS), depreciation expense, utility expense, and wages expense. Companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards.

The importance of a chart of accounts for small businesses

Click here to learn more about SCFO Labs[/box]

If you want to take your company and yourself to the next level, then click here to learn more about the premier financial leadership development platform. Accounts payable is an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers. Not always employed, this

designation is used to control

the order of accounts as

they appear in the financial

statements and can be

beneficial in making them

generally simpler to decipher

and more actionable. This represents a more specific

drill-down of the Account Type,

for a supplementary and highly

detailed view of the entry across

a broader category, such as Fixed

Assets.

What are the two types of numbering system chart?

- Decimal number system (Base- 10)

- Binary number system (Base- 2)

- Octal number system (Base-8)

- Hexadecimal number system (Base- 16)

This influences which products we write about and where and how the product appears on a page. FloQast™ Ops is a workflow manager that extends the power of FloQast Close, providing greater control over accounting operations and optimizing workflows across every function. Read how in just a matter of weeks, Qualys leveraged FloQast to standardize the close process and organize controls and documentation for a more simplified SOX compliance. Learn how to optimize existing processes, collaborate efficiently, and provide more value to your organization.

Assign Category Types

A chart of accounts is a way to keep track of, organize, and record all your business’s finances. It’s a list in your company’s general ledger of your business’s accounts, divided into the categories of Asset Accounts, Liability Accounts, Equity Accounts, Revenue Accounts, and Expense Accounts. Your business’s chart of accounts provides a snapshot of your company’s financial standing. When setting up a chart of accounts, typically, the accounts that are listed will depend on the nature of the business. For example, a taxi business will include certain accounts that are specific to the taxi business, in addition to the general accounts that are common to all businesses.

What is chart numbering system?

Chart of accounts numbering involves setting up the structure of the accounts to be used, as well as assigning specific codes to the different general ledger accounts. The numbering system used is critical to the ways in which financial information is stored and manipulated.

To learn even more about the chart of accounts or to discover additional information about the topic please refer to this guide by Wikipedia. The Spanish generally accepted accounting principles https://www.bookstime.com/ chart of accounts layout is used in Spain. The French generally accepted accounting principles chart of accounts layout is used in France, Belgium, Spain and many francophone countries.

- Published in Bookkeeping

Project Managers’ Roles and Responsibilities in 2023

Content

A Project Manager is responsible for the day-to-day management of specific goals. They work on assignments with definite outcomes and time limits that must stay within budget. Sign up for Workable’s 15-day free trial to post this job and hire better, faster.

- ; ensures all the project activities, strategies and approaches are an integrated effort.

- You should be an excellent communicator and comfortable managing multiple tasks.

- By doing so, they can provide valuable insights into the project’s performance, identify areas for improvement, and help facilitate the future project’s success.

- Monitors teams to make sure the project goals and objectives are being kept.

In any case, the list below shows a rather accurate picture of potential tasks and responsibilities that would be expected of PMs. A Requester can tag a request as proposed if it is not won/authorized yet, in progress if it is being executed, and closed when it is done. Sometimes, requests are set on hold, waiting a more convenient time to decide. When requests are lost or not authorized, it can be tagged as rejected. We could identify another specific role, named Requester for the person who ask for a new project, work hard to get it approved, and then just need to be informed on completion.

What do project managers do in IT?

Once a team is created, the project manager creates a project schedule to assign tasks and deadlines, giving the team the tools to collaborate without micromanaging every activity. It’s important to meet regularly and get status updates to chart progress while reallocating resources as needed to avoid blocking team members or overburdening them. When it comes to technology, we know that file sharing, time tracking, email integration, and budget management are among the top most used and requested features in project management software. In the project manager role, you must understand these digital platforms, own management of these systems, and synthesize data inputs to make decisions for your team. According to a PWC report in the United States, 97% of organizations believe that the project manager role is critical to business performance and organizational success. Two-thirds of companies communicate with clients using project management tools.

Often a combination of multiple methodologies is best depending on the needs of the organization. Regular team meetings are an essential way to keep everyone in the loop and ensure that everyone is on the same page. If the steering committee has any questions or concerns, it’s important to be responsive and address them as quickly as possible. A steering committee is a good idea when different partnering companies, units, or individuals have a strong stake in the project.

The roles and responsibilities of project managers

Learn more about the role of a PM and take a look at some of their daily duties and responsibilities. Effective communication is a crucial skill to https://remotemode.net/ be a good Project Manager. They must use language that everyone on their team understands to clarify what needs to happen and how it should occur.

The vision should be conveyed to the entire team so that they understand the importance of their role to achieve the end results. The team should understand the workload and make the possible efforts to convert goals into missions. The manager should set the appropriate tone for smoother sailing down the road. The objective of the meeting should be met by communicating the rules of the project clearly to the entire team. The project managers should be ready from the beginning to prepare for meeting the objectives.

#8 Quality management

The duties of a project manager include managing resources, keeping the client requirements in check, coordinating with the team and making sure that the outcomes are delivered on time. In conclusion, Project Managers are the driving force behind successful projects. With the right skills, experience, and mindset, a project manager can lead a team to achieve great things and deliver outstanding results. It’s their responsibility to work with the project team to create a detailed project schedule and identify potential risks and issues that could impact the project’s success.

A Project Manager can delete project forecast approved version for the projects they are granted the project manager role on. A Project Manager can assign project enterprise resource for the projects they are granted the project manager role on. A Project Manager can run generate financial plan for the projects they are granted the project manager role on. A Project Manager can edit organization overrides for project for the projects they are granted the project manager role on.

Project manager jobs

Official sign-off prevents stakeholders from conveniently forgetting that they had approved of a certain deliverable and asking for subsequent changes. But, just because they’re unavoidable doesn’t mean they cannot be properly managed. Think that their remaining involvement in the project consists of waiting for the final product to be delivered to them. how to become a project manager It’s best to imagine them as ship captains whose purpose is to thoroughly understand both the project and the route it needs to take to reach its final destination. Gathering information from project staff and other people involved with the project. Motivating and inspiring a team to deliver the project work by providing a vision and direction.

- Published in Bookkeeping

10 Best Accounting & Bookkeeping Software Products for Small Business Reviewed

Content

Quickbooks payroll pricing is very competitive at $45 + $4/employee per month. It’s definitely not the cheapest option, but its full feature set and native integration will more than justify the cost for many businesses. Patriot’s basic package does not include the ability to file and deposit federal, state, and local payroll taxes.

What kind of bookkeeping is used by small businesses with less complex transactions?

Single-entry system of bookkeeping

It maintains only the purchases, cash receipts and payments and sales. It is used mainly by small businesses, which have minimal transactions.

Its one-step reconciliation process is also a big help for small business owners. Reconciling in two steps isn’t necessarily a huge inconvenience — but taking out an extra step can make the process easier. Gusto won’t make you upgrade if you reach 50 employees like ADP Run will. Gusto will integrate with nearly any of your other software, unlike QuickBooks. And Gusto comes with a much longer list of features than Square does. You need to request a quote to find out what each plan would cost you.

Why Choose Payment Rail?

Finally, they generate the reports you need so you’re ready to prepare your taxes or hand them off to your accountant. Wave offers fee-based bookkeeping services, but they lack Intuit QuickBooks Live’s interactive quality. Sage 50cloud Accounting is a massive small business accounting application that’s designed for desktop use.

It is essential for self-employed entrepreneurs and freelancers to quickly and easily send invoices and track payments. For this reason, Sage Accounting is our top choice for these types of small businesses. With Sage, you will have an affordable way to keep the cash bookkeeping and payroll services flowing into your business without unnecessary delays. This accounting software offers well-priced tiered plans with which to create and send invoices and track payments. The software is designed for small business owners who don’t have an accounting background.

Accounting Software Features

These record templates vary in complexity, so you need to understand the differences before you go with one accounting service or another. Some, such as Patriot Software Accounting Premium, simply let you maintain descriptive product records. They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder. Then they actively track inventory levels, which provides insights on selling patterns and keeps you from running low. The Early plan limits usage and only allows entry for 20 invoices or quotes and five bills per month. This limited plan may be suitable for a micro-business with high-ticket transactions but only a few per month, such as a consulting or small service provider.

Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication.

Tracking for Billable Hours

The spare interface gives an immediate picture of your business’s financial position. You can view costs as they happen in real time, then make instant modifications. If you don’t need quite as many features as Wave offers, ZipBooks is a solid free accounting software alternative. ZipBooks’ paid plan starts at $15 a month and offers better bookkeeping and automation features than its free accounting plan.

One Schedule C can be tough enough on its own, which is why it’s imperative to utilize software that has options for multiple businesses. Many business owners especially novices, make the mistake of using too many platforms which adds unnecessary confusion by toggling back and forth between each one. This crucial mistake wastes time that could have been spent on more important purposes. Quality Tax software has changed the game by making processes quicker, less expensive, and more integrated. However, mistakes can happen from time to time, which includes bugs.

QuickBooks Payroll

Its cheapest package, the basic package, cost only $17 + $4/employee every month. And it provides almost all of these same features you would get from other payroll providers. Federal, state, and local pay regulations and rules can change regularly. As the busy https://www.bookstime.com/ owner of a growing small business, it can be difficult to keep track of legislative and bureaucratic changes. Payroll software companies do this for you, allowing you to avoid the unwanted attention of government agencies while focusing on running your business.

What is a small business accounting system?

Small-business accounting software is something you use to access financial information quickly and easily. It lets you check bank balances, understand revenue and costs, predict profitability, predict tax liabilities, and more.

- Published in Bookkeeping

What Are Retained Earnings? Formula, Examples and More

Content

Traders who look for short-term gains may also prefer getting dividend payments that offer instant gains. Dividends are paid out from profits, and so reduce retained earnings for the company. The statement of retained earnings is a financial statement that reports the business’s net income or profit after dividends are paid out to shareholders. This statement is primarily for the use of outside parties such as investors in the firm or the firm’s creditors. Distribution of dividends to shareholders can be in the form of cash or stock.

Retained earnings represent a critical component of a company’s overall financial health, as they indicate the profits and losses the company has retained. If you have used debt financing, you have creditors or institutions that have loaned you money. A statement of retained earnings shows creditors that the firm has been prosperous enough to have money available to repay your debts. An alternative to the statement of retained earnings is the statement of stockholders’ equity.

Additional Resources

The firm need not change the title of the general ledger account even though it contains a debit balance. The most common credits and debits made statement of retained earnings example to Retained Earnings are for income (or losses) and dividends. Occasionally, accountants make other entries to the Retained Earnings account.

Since retained earnings is a real account, this means that the balances in all nominal accounts are eventually shifted into a real account. As mentioned earlier, retained earnings appear under the shareholder’s equity section https://www.bookstime.com/blog/mental-health-billing on the liability side of the balance sheet. For instance, a company may declare a stock dividend of 10%, as per which the company would have to issue 0.10 shares for each share held by the existing stockholders.

What Are Retained Earnings? Formula, Examples and More.

It is prepared in accordance with generally accepted accounting principles (GAAP). The disadvantage of retained earnings is that the retained earnings figure alone doesn’t provide any material information about the company. However, management on the other hand prefers to reinvest surplus earnings in the business. This is because reinvestment of surplus earnings in the profitable investment avenues means increased future earnings for the company, eventually leading to increased future dividends. For example, let’s create a statement of retained earnings for John’s Bicycle Shop.

Retained earnings are the portion of a company’s net income that is not paid out as dividends. Retaining earnings help provide the company with funds for future growth and expansion, including investments in new facilities, equipment, or technology. If the company has a net loss on the income statement, then the net loss is subtracted from the existing retained earnings. Money that is funneled back into the business for growth is a good sign of company health for investors.

Stock Dividend Example

The balance in the corporation’s Retained Earnings account is the corporation’s net income, less net losses, from the date the corporation began to the present, less the sum of dividends paid during this period. Net income increases Retained Earnings, while net losses and dividends decrease Retained Earnings in any given year. Thus, the balance in Retained Earnings represents the corporation’s accumulated net income not distributed to stockholders. The next step is to add the net income (or net loss) for the current accounting period. The net income is obtained from the company’s income statement, which is prepared first before the statement of retained earnings.

The accumulated retained earnings balance for the previous year, which is the first line item on the statement of retained earnings, is on both the balance sheet and statement of retained earnings. If the hypothetical company pays dividends, subtract the amount of dividends it pays from net income. If the company’s dividend policy is to pay 50% of its net income out to its investors, $5,000 would be paid out as dividends and subtracted from the current total. Let’s say that in March, business continues roaring along, and you make another $10,000 in profit. Since you’re thinking of keeping that money for reinvestment in the business, you forego a cash dividend and decide to issue a 5% stock dividend instead.

Non-cash items such as write-downs or impairments and stock-based compensation also affect the account. Companies typically calculate the change in retained earnings over one year, but you could also calculate a statement of retained earnings for a month or a quarter if you want. Retained earnings are an equity balance and as such are included within the equity section of a company’s balance sheet. At the end of 2019, John’s Bicycle Shop had retained earnings in the amount of $90,000, which can be used to invest back into the business, such as by purchasing a larger storefront. The money can also be distributed to John, his brother, and his sister as a dividend, or some combination of the two options. A decrease in retained earnings is not necessarily cause for alarm, as any time you invest money back into your business, your retained earnings will likely decrease.

- Published in Bookkeeping

Bookkeeping Classes- Program Overview

Content

The trained researchers at FlexJobs hand-screen job listings to eliminate ads and scams found on other sites. Find everything from entry-level to executive positions at FlexJobs. If you’re still confused, this three-part video series on getting started as a bookkeeper is a great place to start. Bookkeepers, like many freelancers, are typically charged by the hour rather than making a steady salary. Assuming a 40-hour workweek, this is equivalent to a salary of $35,000 a year. However, bookkeepers can make up to $60 per hour if they receive the right bookkeeping training.

We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. This book will show you all the inside secrets that only experienced freelance bookkeepers know. Business Network International (BNI) is a platform where members meet weekly to discuss business and support each other’s businesses by sharing referrals.

Prioritize your business. We’ll prioritize your books.

We spend all day (and night) ensuring you stay tax-ready all year long. Fire yourself as the accountant, hire us, and take back your time. We take the hassle out of bookkeeping with reliable tech and a dedicated bookkeeper. However, if you want more advanced reporting and a more robust mobile experience, you’re better off looking at other solutions on this list. Billy/Sunrise also got some bad reps for its choices regarding customer loyalty when it was acquired. This website is using a security service to protect itself from online attacks.

As an employee for a bookkeeping or accounting firm, you can still work from home and are not burdened with having to find work yourself. The company will assign clients to you and can focus all your energy on servicing them. However, your earning potential will drop because there is a middleman.

What Are the Benefits of Using Online Bookkeeping Services for Your Business?

The bad thing is that it can be super expensive and the traffic you get may not be the traffic that you want. As you’re figuring out your business in the early days, I feel like unless you have A Guide to Nonprofit Accounting for Non-Accountants a very clear offering and sales process, you’ll just end up wasting your money. The earning potential of bookkeepers and their businesses proves that it’s certainly a profitable area.

- After assigning a weighted score to each category, we formulated rankings for each company.

- This is an introductory course, but it requires a significant time commitment, with about 60 hours of material in all.

- QuickBooks Live is best for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it.

- If you would like to go even further, you can become a licensed Certified Public Bookkeeper, which goes through the National Association of Certified Public Bookkeepers.

- KPMG Spark provides online accounting services for small business companies.

- 1-800Accountant can also provide bookkeeping services for your small business.

This class is taught by Earl Stice and Jim Stice, both accounting professors at Brigham Young University (BYU). It’s the first in a six-course path called “Getting Started in Finance & Bookkeeping.” The downside to Skillshare’s all-inclusive membership is that you’ll lose access to the class materials if your membership expires. Class videos can be downloaded, but only through the Skillshare mobile app. It’s our pick for the best overall thanks to its easy accessibility and high-quality lessons.

Step 2 – Choose Your Web Pages

Wave is PCI Level-1 certified for handling credit card and bank account information. The transactions will appear in your bookkeeping automatically, and you can say goodbye https://simple-accounting.org/smart-accounting-practices-for-independent/ to manual receipt entry. A downside of Pilot is that the main way to communicate with finance experts is via email, which can make it harder to get quick replies.

- In all, you will get a chance to dip your toe into a role as a bookkeeper.

- With xendoo’s expert accounting team watching your back, you’re free to move onward and upward.

- Bank data connections are read-only and use 256-bit encryption.

- If you’ve got a knack for numbers and a good head for organization, starting a bookkeeping business might just be the right choice for you.

- Employees enjoy flexibility, lots of training and development opportunities, and incentive-based income.

- You’ll also get burn rate calculations, which is helpful for startups that need to closely track their spending.

- If your business has multiple workspaces, in-person bookkeeping professionals can be an inefficient solution.

- Published in Bookkeeping

Post-Closing Trial Balance Entries & Examples What is a Post-Closing Trial Balance? Video & Lesson Transcript

Content

The credit to income summary should equal the total revenue from the income statement. All three of these types have exactly the same format but slightly different uses. The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed. It is a record the post closing trial balance is best prepared from the of day-to-day transactions and can be used to balance a ledger by adjusting entries. Companies initially record their business transactions in bookkeeping accounts within the general ledger. Furthermore, some accounts may have been used to record multiple business transactions.

The trial balance is usually prepared by a bookkeeper or accountant. The bookkeeper/accountant used journals to record business transactions. The journal entries were then posted to the general ledger. The trial balance is a part of the double-entry bookkeeping system and uses the classic ‘T’ account format for presenting values.

Eight Steps in the Accounting Cycle

The post-closing trial balance is best prepared from the a.general ledger and the financial statements. In the last step of the accounting cycle, the accountant requires to prepare the post-closing trial balance. This statement is prepared after the accountant makes all necessary adjustments to the general ledger and the adjusted trial balance, and all the suspended accounts are closed. A trial balance is a report that lists the ending account balances in your general ledger. A repository for all of your accounts, every transaction recorded either in your accounting software or in your manual ledgers directly impacts the general ledger. The end result is equally accurate, with temporary accounts closed to the retained earnings account for presentation in the company’s balance sheet.

In a real company, most of the mundane work is done by computers. Accounting software can perform such tasks as posting the journal entries recorded, preparing trial balances, and preparing financial statements. Students often ask why they need to do all of these steps by hand in their introductory class, particularly if they are never going to be an accountant. If you have never followed the full process from beginning to end, you will never understand how one of your decisions can impact the final numbers that appear on your financial statements. You will not understand how your decisions can affect the outcome of your business. Permanent accounts are accounts that once opened will always be a part of a company’s chart of accounts.

Business Development

The accounting cycle begins with the journalizing of transactions and ends with the post-closing trial balance. The most significant output of the accounting cycle is the income statement and balance sheet. Business owners prepare a trial balance more than once during the accounting cycle.

- Why was income summary not used in the dividends closing entry?

- But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation.

- In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts.

- On the other hand, a post-closing trial balance is prepared after the closing entries have been made, which involves transferring the balances of temporary accounts to the retained earnings account.

- The purpose of the post-closing trial balance is to ensure that the total debits equal the total credits, which confirms that the accounting records are in balance and accurate.

It is repeated in the same order in each accounting period. Business owners love Patriot’s accounting software. After you enter all your information into the, find the debit total by adding up all the amounts in the debit column.

What are the four closing entries in order?

For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase. Each individual’s unique needs should be considered when deciding on chosen products.

Summarizing refers to the preparation of a trial balance from the debit and credit balances of the ledger accounts. The process of transferring entries from the journal to the ledger is called posting. In this step, all transactions previously recorded in the journal are transferred to the relevant ledger accounts at some appropriate time. The key difference between a trial balance and a balance sheet is one of scope.

The post-closing trial balance lists only the asset, ____, and owner’s capital accounts. A….

A balance sheet records not only the closing balances of accounts within a company but also the assets, liabilities, and equity of the company. It is usually released to the public, rather than just being used internally, and requires the signature of an auditor to be regarded as trustworthy. KLO’s adjusted trial balance for the current month is presented below and the temporary accounts are highlighted to demonstrate how these accounts will be closed. Having a zero balance in these accounts is important so a business can compare performance across periods, particularly with income.

Businesses prepare a trial balance regularly, usually at the end of the reporting period to ensure that the entries in the books of accounts are mathematically correct. The trial balance is the first step toward recording and interesting your financial results. Preparing the trial balance perfectly ensures that the final accounts are error-free. The last and final phase of bookkeeping is the preparation of the post-closing trial balance. This proves the accuracy of the accounting records at the end of the trading period. In double-entry accounting, your debits must equal your credits.

- Published in Bookkeeping

Nonprofit Accounting & Bookkeeping services in San Francisco, Bay Area & Oakland, CA Nonprofit Suite

Content

Every month, you should expect a reconciliation sent to your inbox. A part of the firm known as Block Advisors has tax professionals that specialize in small businesses. The team will ensure that you receive the best service and track your expenses accurately. Small Business Accountant offers affordable and personalized services in San Francisco. The company has great experience from dealing with businesses in the Bay area for more than 15 years. The company works with various software, including Wave, Intuit QuickBooks, Sage Accounting, and Xero.

Ensuring that your employees are paid on time and accurately is critical to retaining top talent and keeping your business running smoothly. With our payroll services, you can manage everything in one place. With Bench, you get a team of real, expert bookkeepers in addition to software. You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials.

Related Articles for Business Owners

With our hands-on approach, tailored service offerings, and quick turnaround times, you can finally have peace of mind knowing that your finances are in good order. Our team of experienced bookkeepers will help you take control of your books so you can get back to running your business. Many business owners try to save money by personally handling bookkeeping tasks. However, you can save even more money and avoid costly mistakes by using the service of a professional bookkeeper.

Finally, we know what government incentives are available to help cut startups burn – our work is helping our startups save over $3 million in burn this year. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct. If you need to share files with your bookkeeping team, it’s as simple as uploading a file. Whether you have questions around Gross Receipts Tax or understanding the California corporate tax rate, we know how to serve your business’ unique bookkeeping and tax needs.

Law Offices of Robert L Goldstein

We love to help companies grow by implementing a simple balance — they’re in charge of focusing on their business goals while we take charge of their books. And we can guarantee that you’ll be hard pressed to find what we offer in other accounting companies. Acuity is modern-day accounting, built specifically to serve startups, entrepreneurs, and small businesses alike. Our bookkeepers have years of experience and are experts in bookkeeping for small businesses.

What exactly does a bookkeeper do?

Bookkeepers are responsible for providing accurate, up-to-date financial information about a business. They're always taking the pulse of a business. Most often, their reports go to business owners and managers to help them make decisions. Some bookkeepers, however, are actually involved in strategy development.

It could be hey, I need to turn my books around really quickly because I have an all-hands meeting in a couple of days. Whatever it is, whatever you need, we are going to try our best to go beyond your expectations and make sure you’re taken care of. Fundraising is probably bookkeeping services san francisco one of the most stressful times for a founder. So the best startups know that they have an experienced bookkeeper near them, ready to help them fly through due diligence. We’ll work with you to connect accounts and pull the data we need to reconcile your books.

Grow With Your Business

We have offices in San Francisco, San Jose (Silicon Valley), Santa Monica (Los Angeles) and New York, and our trained accountants and bookkeepers serve clients all over the United States. Together we’ve created an all-in-one back office solution for VC backed startups. Most importantly, we love what we do and look to form lasting partnerships with our clients. We also help startups navigate an exit; an average of 1 to 3 of our clients are acquired any given month.

A dedicated team will ensure that your business’s back-office operations run smoothly. Therefore, you can worry less about your business’s financial tasks, from cash flow management to profit analysis. Liz Is All Biz is an accounting company based in San Francisco that specializes in helping clients reach their fiscal and organizational goals. Their clients have praised them for their knowledge in accounting and their organizational skills. Even if you’ve got a system in place, the amount of time needed to crunch the numbers, sort the records, and properly file everything for a smooth process come tax season can be overwhelming. Books In Balance provides accounting and bookkeeping services, so all of your expenses, invoices, and other itemization goes directly to us.

Books In Balance

Our packages are differentiated based on cost, delivery date of financial statements, allotted transactions per month, and communication channels with your bookkeeper. Our accounting services are part of our more complex, advisory services. We’re not just keeping your financials organized, but also taking the extra steps to understanding and interpreting your financials.

The company’s bookkeepers are equally QuickBooks experts and will accurately handle your files. Safe Harbor LLP works with diverse industries, including non-profit organizations, small businesses, and tech firms. Also, the company offers Stride Vista, a dynamic business intelligence platform. You can, however, gain access to broader customization and integrations by upgrading the package to an advanced plan. Vista organizes business data like spreadsheets, financial statements, and time tracking into one place. Rigits offers tax services for businesses in the San Francisco area.

Flex Tax and Consulting Group

If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one. Yes, San Francisco has a Gross Receipts Tax which varies depending on your business’ gross receipts and industry. Our team of experts can help you better understand GR and if this applies to you.

- We have established a process to keep you updated on your business’s financial progress.

- Startups, especially San Francisco Startups, need a bookkeeper experienced in startup accounting.

- And you don’t want your accounting to be the reason that your Series A is delayed by four months.

- A professional team will help you categorize transactions, reconcile payments, and prepare financial statements.

- Whatever it is, whatever you need, we are going to try our best to go beyond your expectations and make sure you’re taken care of.

- The company has a professional team passionate about accounting and managing books.

If you decide to go with us, we’ll take bookkeeping off your plate—for good. We use Plaid, which lets you securely connect your financial accounts to Bench in seconds. This feature saves you the time and effort of manually uploading documents.

- Published in Bookkeeping

How do I receive payments from my PayPal account to my Revolut Business account? Revolut BE

Content

Keeping your personal and business accounts separate is also much better for tax purposes. A PayPal business account is simply an account used by businesses to send and receive payments. It can be used to process payments online and in person and you can link it up with your business bank account to transfer your money. You can offer your customers an easy way to pay the invoice using a credit or debit card—they don’t need a PayPal account. PayPal invoice payments are automatically reconciled in QuickBooks, saving you hours of admin.

Yes, it is possible to use a personal PayPal account for your business but it’s not always the best idea. With customer engagement and retention hinging on a seamless UX, Zettle by PayPal understood the importance of integrations that could provide merchants with the connectivity they expect. QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. Businesses whose home currency is not GBP are currently not supported. As an additional option, use a backup restore app before connecting the app.

Power your practice with integrated software

It is possible to find alternative provider AND save costs on the gateway and merchant services when switching accounts. Merchant Advice Service always suggest comparing accounts on a pound for pound basis in order to ensure costs/fees are saved where possible. If you are an ecommerce company, we suggest that accounts are reviewed every 12 months. Zettle by PayPal’s merchants have diverse accounting needs that differ depending on their sector, transaction volume, location, and approach to bookkeeping. To maximize efforts and minimize workloads, merchants expect their PoS solutions to integrate seamlessly with their accounting software. Improve your sales by giving customers more ways to pay online through PayPal.

Discover the possibilities with PayPal and give your customers more ways to pay your invoices every time. After trying out a couple of complex accounting software programmes with great struggle. I jumped over to 10 Minute Accounts and i must say it is impressive. Nearly all of my accounting is done for me, it is fully integrated bookkeeping for startups with PayPal so therefore logs all of my expenses & income for me. It provides me with all of the required information to rapidly fill in a tax return. Super easy to use with no overly complicated setup, it lists all your sales, expenses etc one click and future transactions are all categorized and everything is customizable.

Merchant Technical Support

Exporting your PayPal transaction history is just slow and unnecessary. As part of this they send me a paymetn of 0.01 to my bank account. If you haven’t already, confirm your email address to start accepting payments. Another option is to have family or friends send you a PayPal payment which could be deposited fairly quickly, depending on how they choose to pay. Within a few minutes, PayPal will send a confirmation link to your registered email address.

- Published in Bookkeeping

Online Bookkeeping Services for Small Businesses

Content

By outsourcing your bookkeeping and accounting to Remote Quality Bookkeeping, you pay a flat monthly rate with no hidden fees or added expenses. Bookkeeping services with Remote Quality Bookkeeping can help you save up to $30,000 per year when compared to an in-house bookkeeper. Many small businesses fail because they don’t properly manage their finances. Without accounting experience, it’s impossible to see the big picture of small business bookkeeping. Luckily, our specially trained small business bookkeepers can help you maintain accurate financial records, keep tabs on your cash flow, and budget for the future so your small business can thrive. This gives you the space to manage your business and make sound financial decisions as your company grows and flourishes.

Is online bookkeeping a good business?

Is virtual bookkeeping profitable? Yes, virtual bookkeeping is a profitable business idea. Bookkeepers are in demand as most businesses and freelancers need to keep records to calculate taxes and manage finances.

Our expert team will process all of your payroll needs quickly and efficiently. Have you fallen behind in keeping accurate books or filing taxes? Do you suspect there is theft or embezzlement at your company? Our team of professionals will find you answers at a fraction of the cost of a private CPA.

Want More Helpful Articles About Running a Business?

These trained individuals can focus solely on the business’s accounting aspects. While hiring them will save you a lot of time, it will likely cost you a substantial amount of money. The least expensive pricing plan starts at $349 monthly and can reach as high as $699. The additional features can further increase the monthly costs.

Nearly all businesses can take advantage of a remote bookkeeper. Most of the work a bookkeeper does can be completed using a computer and internet connection, which means your bookkeeper can easily operate from anywhere in the country. You’ll just need to take the required steps to grant the remote bookkeeper access to any accounts or data they need to operate.

Features

Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years. She holds a Bachelor’s degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about travel, food, and books for various lifestyle publications. 1-800Accountant reviews show that its dashboard is user-friendly and easy to navigate. Users also praised the virtual accounting firm’s business formation services and the transparency of fees and services.

- The cost also depends on the level of service and the size of your business.

- With our accounting services, a team of professional accountants, including a CPA and CFO, will manage everything remotely.

- QuickBooks Live is best for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it.

- Without accounting experience, it’s impossible to see the big picture of small business bookkeeping.

Our skilled staff will oversee your data entry, reconciliation, and reporting so you can focus on pursuing your passion. When your books are a mess, https://marketresearchtelecast.com/financial-planning-for-startups-how-accounting-services-can-help-new-ventures/292538/ it’s impossible to achieve long-term financial stability. Once Remote Quality Bookkeeping takes over, your business’s financial status will improve.

- Published in Bookkeeping

Applying the Lessons of Enrons Mark-to-Market Accounting Scandal Today

Content

The intent of the standard is to help investors understand the value of these assets at a specific time, rather than just their historical purchase price. As initially interpreted by companies and their auditors, the typically lesser sale value was used as the market value rather than the cash flow value. Many large financial institutions recognized significant losses during 2007 and 2008 as a result of marking-down MBS asset prices to market value. Therefore, the amount of funds available is more than the value of cash (or equivalents). The credit is provided by charging a rate of interest and requiring a certain amount of collateral, in a similar way that banks provide loans. Even though the value of securities (stocks or other financial instruments such as options) fluctuates in the market, the value of accounts is not computed in real time.

Similarly, if the stock decreases to $3, the mark-to-market value is $30 and the investor has an unrealized loss of $10 on the original investment. For example, homeowner’s insurance will list a replacement cost for the value of your home if there were ever a need to rebuild your home from scratch. This usually differs from the price you originally https://marketresearchtelecast.com/financial-planning-for-startups-how-accounting-services-can-help-new-ventures/292538/ paid for your home, which is its historical cost to you. This gives us a trail to investigate to try and quantify Tesla’s specific risks involved with their decision to use mark-to-market accounting. As investors, even the most knowledgeable of us may never be able to shield ourselves from every type of future accounting fraud.

Premium Investing Services

At the same time, if you trade futures, or any derivative instruments for that matter, your futures broker will mark your positions to market each day. In the financial services industry, companies that default on their loans will need to make adjustments to their asset accounts. In the event of a default, the loans must be qualified as bad debt or non-performing assets. The company must mark down the fair value of its assets by creating an account called bad debt allowance.

Commissions and other costs of acquiring or disposing of securities aren’t deductible but must be used to figure gain or loss upon disposition of the securities. For more information on investors, bookkeeping for startups refer to Publication 550, Investment Income and Expenses. Marking to market is an essential part of the daily settlement process for any instruments that are traded on margin.

What you need to know about mark to market accounting.

The most infamous use of mark-to-market in this way was the Enron scandal. Mark to market trading was developed throughout the 20th century – however, it wasn’t until the 1980s that the practice was taken up by banks and major corporations. A futures trader would begin an account by depositing money with the exchange, called a margin. The contract is marked at its current market value at the end of every trading day. If the trader is on the positive side of a deal, the exchange pays the profit into his account. If the trader is on the negative side of the deal the exchange charges him the loss that holds his deposited margin.

While FAS 157 does not introduce any new requirements mandating the use of fair value, the definition as outlined does introduce certain important differences.

What is Mark-to-Market Accounting?

For instance, if the margin of the assets drops below the requirement, the trader is likely to face a margin call. Mark to market is important for futures contract which involves a long trader and a short trader. Futures contracts involve two parties, the bullish (long trader) and the bearish (short trader), if a decline in value occurs, the long account will be debited while the short account credited due to the change in value. This means that the trader with a short position in the future contact tends to benefit more from a fall in the value of the contract than the trader with a long position. However, daily mark to market settlements in future contracts continue until either of the parties closed his position and goes into a long contract. Fair value accounting did not cause the current financial crisis, but the crisis may have been aggravated by common misperceptions about accounting standards.

- In this article we will break down the idea behind mark to market accounting and why it’s important for investors and traders in different ways.

- In the financial services industry, there is always a probability of borrowers defaulting on their loans.

- And the fair value accounting approach of “marking to model” could gain some credibility with investors if they were given the assumptions underlying these models.

- In theory, this price pressure should balance market prices to accurately represent the “fair value” of a particular asset.

- The impact of the IASB proposal on quarterly earnings will be the key factor in whether the EU decides to adopt it.

- Published in Bookkeeping